Debt Investors

DS Smith funds its operations from the following sources of capital: operating cashflow, borrowings, shareholders’ equity and, where appropriate, disposals of non-core businesses.

The Group’s objective is to achieve a capital structure that results in an appropriate cost of capital whilst providing flexibility in short and medium-term funding so as to accommodate material investments or acquisitions. The Group also aims to maintain a strong balance sheet and to provide continuity of financing by having a range of maturities and borrowings from a variety of sources.

Borrowing facilities

DS Smith finances its operations using a number of funding instruments, including Medium-term notes, private placement debt and bank borrowings.

Borrowing facilities as at 30 April 2024

| Facilities | Currency | Maturity | £ million equivalent |

|---|---|---|---|

| Syndicated RCF 2018 | various | 2024-25 | 1,4001 |

| Euro medium-term notes | EUR | 2024-30 | 2,182 |

| Euro RCF 2020 | EUR | 2024 | 51 |

| Sterling bond medium-term note | GBP | 2029 | 250 |

| Euro term loan | EUR | 2025 | 9 |

| Total | 3,892 |

1An extension of the syndicated RCF facility was agreed in June 2024, such that new facility of £1.25 billion matures in May 2027.

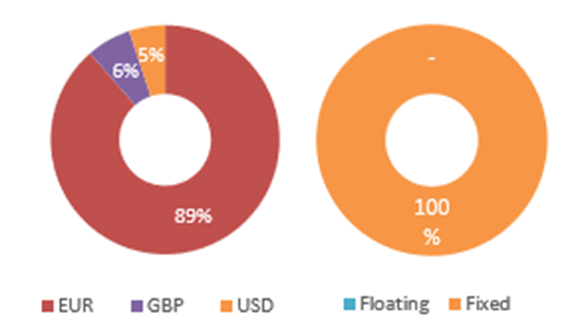

Analysis of Gross Debt at 30 April 2024

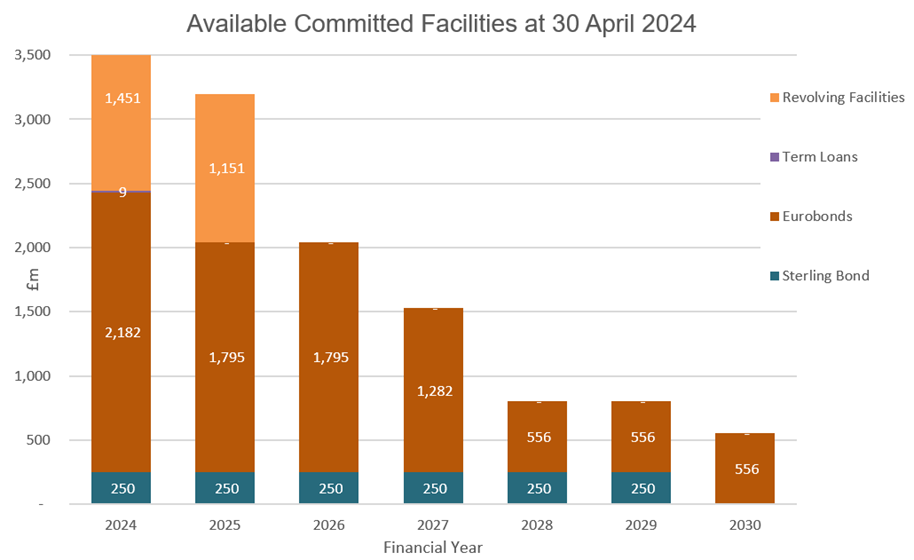

Available committed facilities as at 30 April 2024

Euro Medium-term Note Programme

| Maturity date | Issued amount | Coupon | Interest paid | Date | Minimum denominations |

|---|---|---|---|---|---|

| 26 July 2024 | €452m1 | 1.375% | annually | 26 July | €100k |

| 12 September 2026 |

€600m |

0.875% | annually | 12 September | €100k |

| 26 July 2029 | £250m | 2.875% | annually | 26 July | £100k |

| 27 July 2027 | €850m | 4.375% | annually | 27 July | €100k |

| 27 July 2030 | €650m | 4.500% | annually | 27 July | €100k |

1 Following repurchase of €298m in July 2023